2024 P/C Cynamic Insurance: The best in more than a decade

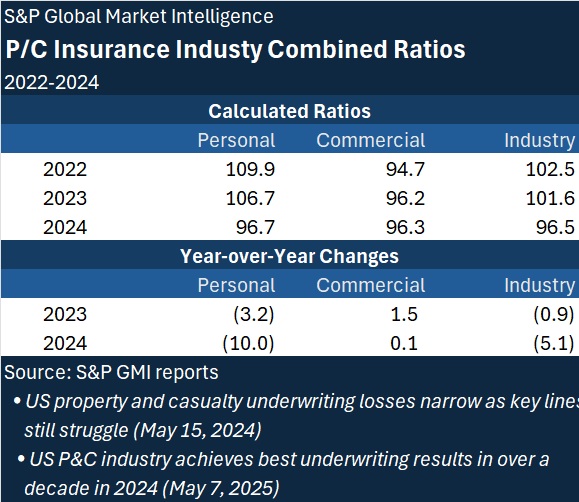

With the common lineage of personal and commercial lines that land only 0.4 points from last year, the compact percentage of 2024 in the real estate/injuries insurance/injuries 96.5 – was characterized by the lowest number since 2013, according to a new report.

Drafting the total number of the slightly higher industry that was released earlier this year using data from the legal voids provided during late April, analysts at the S&P Global Market Market Intelligence reported more than 5 points of improvement in the integrated P/C number, and a decrease of 10.0 points in the personal lines combined.

Through the latest S&P GMI accounts, the percentage of personal lines was 2024 combined 96.7. The percentage of commercial lines was 2024 combined 96.3, a little higher than the 96.2 report of 2023.

The S&G GMI report, “P&C US, the best subscription results for more than a decade in 2024”, includes the written graphs that display 10 years of common lineage of two individual characters, private car memories and private homes, interactive graphic drawing that allows readers to see the historical proportions integrated for 10 different commercial lines, including parts of the commercial style, and different Property.

Among the main ideas revealed by the data:

- The homeowners line showed the largest improvement in the collection ratio last year, as it decreased 11.2 points to 99.7.

- This represents the first annual profit for the subscription award in homeowners since 2019.

Noting that homeowners profit came despite the losses of large disasters from thermal storms and major hurricanes, the report shows that high installments and recovery rates from re -securing citizens of non -resident have benefited from home owners insurance companies. Another factor – a material part of the cat’s losses caused by floods, which are not covered by the policies of traditional home owners.

- Auto for private passengers witnessed the largest improvement – 9.6 points last year. Auto Combined Auto Companize for 2024 decreased from 95.3, to nearly 17 points from its peak in the contract – 112.2 in 2022.

- On the commercial side of cars, the percentage of 2024 combined of 107.2 was only 2.1 points from the level of 109.3 registered in 2023. Despite the decrease of approximately 8 points in the material damage rate of commercial cars, a high -level responsibility rate of 113.0 made it clear.

- Commercial property ratios- to see the fire and allied and multi-commercial lines (non-responsibility)- all improved last year, with the spread of the best common proportion of 2024-77.2.

- The common percentage of workers in 2024 was the best result among those stipulated in the S&G GMI report is the proportion of workers ’companies of 88.8. While it rose from 88.1 in 2023, and from the lowest level in the 86.4 contract in 2018, the result remains much lower than the 95.6 registered contract in 2015.

- Among the lines of responsibility shown in the report-another responsibility, the responsibility of the product, the multi-performance commercial responsibility and the poor medical practice-only improved Med Mal.

- The other responsibility line witnessed a sharp deterioration of commercial lines, as it rose 10 points to 110.1 in 2024, compared to 100.1 in 2023.

The report indicates that a quarter of a quarter of commercial lines were reported in the United States almost reported under the other business line of business, which includes general responsibility, commercial increase and umbrella, errors and negligence, cybersecurity-and that the ratio assembled 110.1 is the percentage that was recorded the highest recorded percentage since 2016 (when it was 110.9).