Introduction: Bailey says the Bank could become ‘a bit more activist’ on interest rates

Good morning and welcome to our regular coverage of business, financial markets and the world economy.

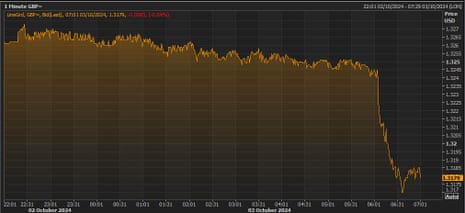

The pound fell to a two-week low this morning after the governor of the Bank of England told the Guardian that the central bank may become “a little more aggressive” in cutting interest rates provided the inflation news continues to be good. .

Andrew Bailey told us that he was encouraged by the fact that cost of living pressures had not been as persistent as the Bank thought they might be.

In an interview with my colleague Larry ElliottBailey says that if the inflation news continued to be good, there was a chance the Bank would become “a bit more active” in its approach to cutting interest rates, now at 5%.

That sent the pound down 0.8 of a cent to $1.3185, its lowest level since September 19 (just before the Fed’s rate cut).

The bank has recently been more cautious about rate cuts than its US and eurozone counterparts. It has only cut by a quarter point this year, in August, while the Federal Reserve has cut US rates by half a point and the European Central Bank has cut by two quarter points since June.

The bank is scheduled to set interest rates in early November; money markets suggest there is an 88% chance of a cut, to 4.75%.

Bailey made the comments in a wide-ranging interview in which he explained that he was watching developments in the Middle East “extremely closely”.

Bailey told us:

“The geopolitical concerns are very serious.

It is tragic what is happening. There are definitely stresses and the real issue is how they can interact with some markets still quite stretched across countries.”

Bailey said that in the year since Hamas’s attack on Israel there had not been a large increase in oil prices like that seen in the past.

He explained:

“From a monetary policy point of view, it’s a big help that we haven’t had to deal with a big increase in the price of oil. But obviously we’ve had that experience in the past, and in the 1970s, the price of oil was a big part of the story.

“Obviously, we continue to look at it. We watch it extremely closely to see the impact of the latest news. But … my sense from all the conversations I have with counterparts in the region is that there is, at the moment, a strong commitment to keeping the market stable.

Here is the full interview:

Agenda

-

9am BST: Eurozone services PMI for September

-

9.30am BST: UK services PMI for September

-

10:00 BST: Eurozone producer price index for August

-

12.30pm BST: Challenging US job cuts survey for September

-

13:30 BST: Weekly US jobless claims report

Main events

In the foreign exchange markets, the pound continues to fall against the US dollar.

Sterling has now lost a full cent to $1.3161 as investors digest Andrew Bailey’s suggestion that the Bank may become “a bit more aggressive” in cutting interest rates provided inflation news continues to be good .

Inflation was last seen at 2.2% in August, just above the Bank’s target of 2%.

Our interview with Andrew Bailey is also moving the government bond market, it seems.

This just appeared in Reuters:

Gilts are UK government bonds. And prices are rising at the start of trading, which lowers the yield (or interest rate) on the debt.

The yield on 10-year Treasury notes (a benchmark for government borrowing) fell 30 basis points to 4.011%, from 4.041% last night.

This means that the price of the bond has risen and indicates that investors are betting on deeper UK interest rate cuts in the coming months than before.

The pound is also losing ground against the euro, as well as against the dollar.

Sterling fell by 0.66%, or three quarters of a eurocent, to €1.1933 against the euro this morning, from €1.2012 last night.

Bloomberg’s Markets Today liveblog noted that Andrew Bailey’s comments “are rippling through bets on a Bank of England rate cut.”

Investors are now more confident that the Bank will reduce borrowing costs in the coming months.

of Bloomberg Sam Undecided explains:

Having wavered slightly so far this week, a 25 basis point cut in November is now fully priced in again. And the stakes are increasing even further on the horizon, with 125 basis points of prices already up to June next year.

Pound slips to two-week low against dollar after misleading comments from Bank of England Governor Andrew Bailey https://t.co/Wl4GwPVT6d

— Bloomberg UK (@BloombergUK) October 3, 2024

Analyst: Andrew Bailey chokes the pound

Sterling has been shocked by the strange comments from the governor of the Bank of England, Andrew Bailey, in today’s interview with the Guardian, it says. Kathleen Brooksresearch director at XTB.

Brooks notes that the dollar has also benefited from ‘safe haven flows’ as nervous investors try to protect their money due to the crisis in the Middle East.

It says it has been a ‘bruising week’ for the pound, which may have fallen further against the dollar.

In a note entitled “Andrew Bailey chokes the pound,” Brooks explains:

The pound was already selling off ahead of Bailey’s comments, and GBP/USD is down more than 1% so far this week, down from $1.34 earlier this week to below $1.31 this morning.

It has found good support at $1.3170, however, this has been a bruising week for the pound and $1.35 looks like a mountain to climb from here. Part of the pound’s selloff is due to external factors. As geopolitical risks in the Middle East have increased, the US dollar has caught a bid. Currencies that were more stretched against the US dollar have sold off rapidly as investors have sought the safety of the greenback.

The pound and yen were therefore in the sellers’ sights as markets tried to buy dollars. The pound is still the best performing currency in the G10 FX space so far this year, so if tensions escalate further then we could see another leg lower for GBP/USD [the pound against the dollar].

Tesco raises profit forecast

Sarah Butler

Supermarket chain Tesco has announced that it now expects to make a profit of £2.9bn for the year, up from £2.8bn previously forecast.

Tesco says it will make £100m more than expected after grabbing share from rivals by cutting prices, putting more staff in store and using AI to target local taste ranges.

The UK’s biggest supermarket said it had made £260m of cost savings in the six months to 24 August and also benefited from restructuring its bank and buyers trading up to higher-priced products after the crisis the cost of living has eased.

The retailer said a further 20 million people had bought its Finest premium label range.

The dollar is also strengthening against other currencies this morning.

Reuters reports:

The dollar climbed to a more than six-week high against the yen on Thursday as firmness in the US labor market reinforced bets that the Federal Reserve will not rush to cut interest rates.

Sterling fell to a two-week low after Bank of England Governor Andrew Bailey said in an interview with the Guardian newspaper that the central bank could become “a bit more active” in cutting rates if there was further good news for inflation.

The euro fell to a three-week low after normally dovish European Central Bank policymaker Isabel Schnabel took a tougher tone on inflation, cementing bets on a rate cut this month.

The yen has been under selling pressure since Japan’s new prime minister said Wednesday, after a meeting with the central bank governor, that the country is not ready for additional rate hikes.

⚠️ Exclusive: Bailey held out the possibility that the Bank could become “a little more aggressive” in cutting interest rates provided the inflation news continues to be good.$GBP offered in this news pic.twitter.com/tMbnTTzBHg

— PiQ (@PiQSuite) October 3, 2024

Introduction: Bailey says the Bank could become ‘a bit more activist’ on interest rates

Good morning and welcome to our regular coverage of business, financial markets and the world economy.

The pound fell to a two-week low this morning after the governor of the Bank of England told the Guardian that the central bank may become “a little more aggressive” in cutting interest rates provided the inflation news continues to be good. .

Andrew Bailey told us that he was encouraged by the fact that cost of living pressures had not been as persistent as the Bank thought they might be.

In an interview with my colleague Larry ElliottBailey says that if the inflation news continued to be good, there was a chance the Bank would become “a bit more active” in its approach to cutting interest rates, now at 5%.

That sent the pound down 0.8 of a cent to $1.3185, its lowest level since September 19 (just before the Fed’s rate cut).

The bank has recently been more cautious about rate cuts than its US and eurozone counterparts. It has only cut by a quarter point this year, in August, while the Federal Reserve has cut US rates by half a point and the European Central Bank has cut by two quarter points since June.

The bank is scheduled to set interest rates in early November; money markets suggest there is an 88% chance of a cut, to 4.75%.

Bailey made the comments in a wide-ranging interview in which he explained that he was watching developments in the Middle East “extremely closely”.

Bailey told us:

“The geopolitical concerns are very serious.

It is tragic what is happening. There are definitely stresses and the real issue is how they can interact with some markets still quite stretched across countries.”

Bailey said that in the year since Hamas’s attack on Israel there had not been a large increase in oil prices like that seen in the past.

He explained:

“From a monetary policy point of view, it’s a big help that we haven’t had to deal with a big increase in the price of oil. But obviously we’ve had that experience in the past, and in the 1970s, the price of oil was a big part of the story.

“Obviously, we continue to look at it. We watch it extremely closely to see the impact of the latest news. But … my sense from all the conversations I have with counterparts in the region is that there is, at the moment, a strong commitment to keeping the market stable.

Here is the full interview:

Agenda

-

9am BST: Eurozone services PMI for September

-

9.30am BST: UK services PMI for September

-

10:00 BST: Eurozone producer price index for August

-

12.30pm BST: Challenging US job cuts survey for September

-

13:30 BST: Weekly US jobless claims report