On a typical Friday night in the 1990s, a large number of US families flocked to their local Blockbuster to get some weekend entertainment by renting a movie or a video game cartridge. The chain was a dominant force in its segment of the entertainment space. But over time, its management failed to respond effectively to growing competition from companies that first offered DVD rentals by mail and then video-on-demand streaming. It is clear how it turned out.

In short, the business models that work best today are not guaranteed to thrive forever. And when you think about it, this can be especially problematic for long-term investors. Warren Buffett has often said, “If you wouldn’t consider owning a stock for 10 years, don’t even consider owning it for 10 minutes.” But so much can change in 10 years — an entire business model can become irrelevant in that time.

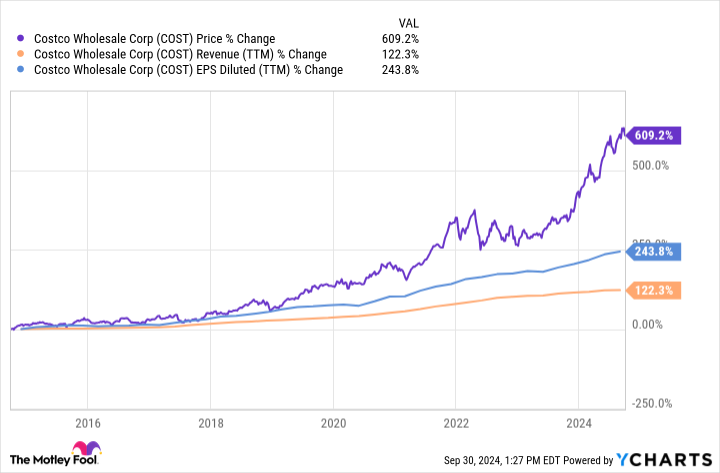

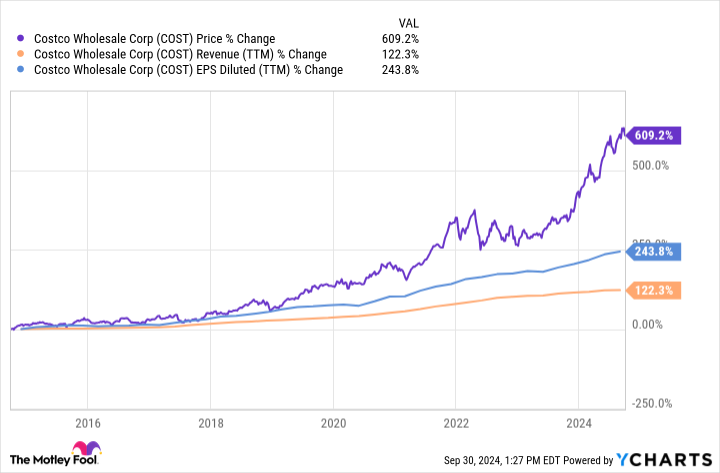

Retail chain Costco wholesale (NASDAQ: KOST) is one of the most popular companies on the stock market right now, and understandably so. Over the past 10 years, it has more than doubled its revenue as it has opened new locations and acquired new members. Earnings have grown with strong operational efficiency, and this has resulted in big gains for the stock.

But how can investors predict what the next 10 years have in store for the warehouse chain? How confident can those buying Costco stock today be about how the business will fare a decade into the future? Well, management only provided one metric that is extremely promising when considering the importance of Costco’s long-term business.

Statistics that buy and hold investors should see

Costco makes most of its profit from selling memberships. Customers must pay annual membership fees to shop in its many warehouse-style stores, but are rewarded with low prices. The company has nearly 900 locations worldwide and nearly 137 million members.

According to Costco management, it added about 9 million new cardholders during the 2024 fiscal year, which ended Sept. 1. But here’s the important statistic for long-term investors: Of those 9 million new members, roughly half were under 40. Additionally, the average age of Costco members has steadily declined since the start of the COVID-19 pandemic.

Costco’s membership renewal rate is over 90%, and has been for a long time. Therefore, it is reasonable to assume that many of these new Costco members will remain members for many years.

It should be immediately obvious why this information is important. Buy and hold Costco investors are trying to predict the future of the business. Considering the chain’s customer base is getting younger and renewal rates remain strong, I’d say Costco’s business is looking pretty healthy when it comes to long-term relevance.

What does this mean?

It is important to remember that a business and its stock are related, but they are not exactly the same. A business may be poised for long-term resilience, but that doesn’t necessarily mean investors will enjoy strong returns. Therefore, even more information is required when building an investment thesis for Costco stock.

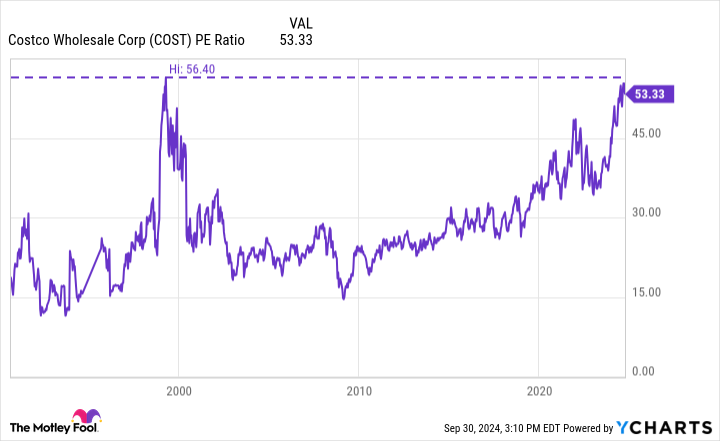

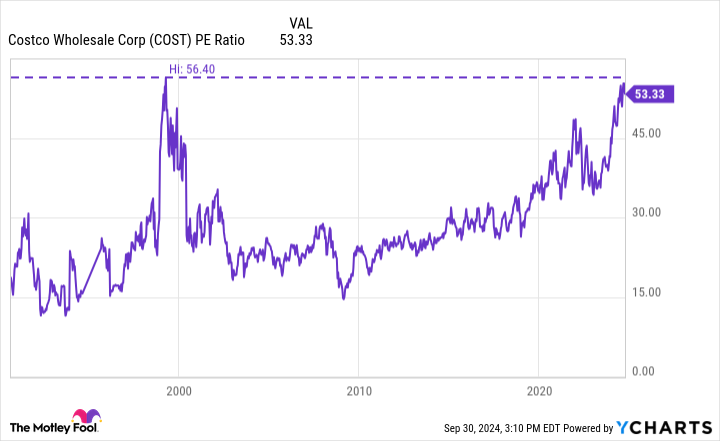

One thing investors should keep in mind today is that Costco trades at more than 50 times its earnings — that’s pretty expensive for a low-growth business. In fact, its shares haven’t been this expensive since the dot-com bubble more than 20 years ago.

This metric would lead me to believe that Costco stock may be somewhat overvalued right now. Consequently, I wouldn’t be surprised if the stock goes lower over the next year, which would give investors a more attractive entry point.

But take this comment with a grain of salt. Valuation is only one part of investing, and it’s not even the most important part. Identifying businesses that can thrive and grow for 10 years or more is a much more important exercise.

Costco’s customer base is getting younger and its renewal rates are holding strong. If you’re an investor who might have been worried about the long-term future of this brick-and-mortar retail chain, this information should help put your mind at ease.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

of Motley Fool Stock Advisor the team of analysts just identified what they believe they are Top 10 Stocks for investors to buy now… and Costco Wholesale was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $716,988!*

Stock advisor provides investors with an easy-to-follow plan for success, including instructions for building a portfolio, regular updates from analysts, and two new stock picks each month. of Stock advisor the service has more than quadrupled return of the S&P 500 since 2002*.

See 10 shares »

*Stock Advisor returns on September 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Are you concerned about Costco’s long-term business? You will want to see this statistic. was originally published by The Motley Fool